How stressful is Malaysia's stress test?

The IMF has published Bank Negara's parameters for stress testing a while back.

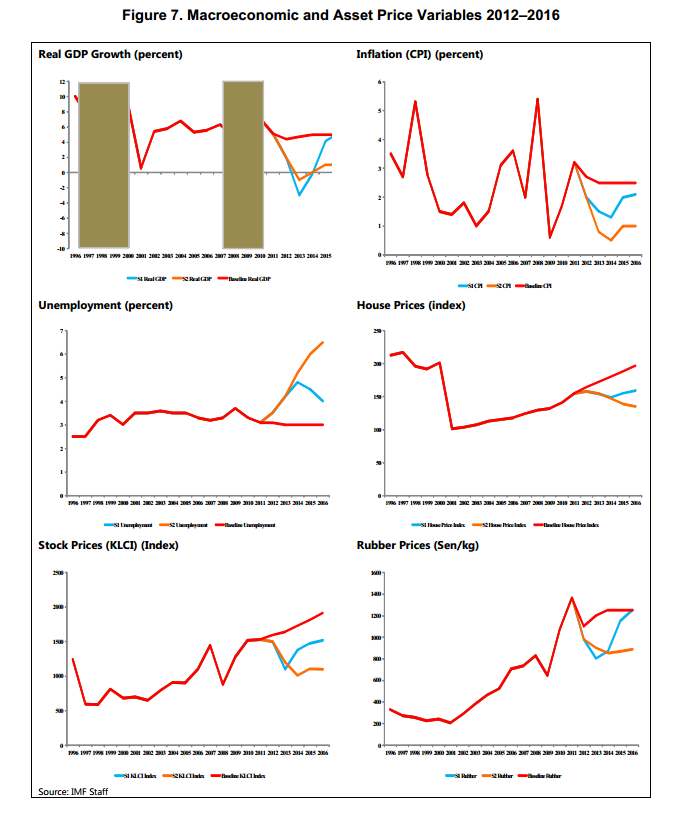

A short primer, is that the stress tests are run for two scenarios. One, a sharp drop to about -2 percent and then a V-shaped recovery. Another is a slower drop to just below 0 percent GDP, but followed by a slower paced recovery.

I'm glad to say that Bank Negara follows Basel's baseline -2 percent GDP adverse scenario, which will likely be what will happen when Malaysia puts institutes the GST. But the tests are not stressful enough. I'd like to see a scenario where S1 drops to -2 percent and then slowly recovers because that is what will likely happen when Malaysia institutes the GST.

If the world economies suffer, the stress tests will be a shambles. Actually Malaysia should include the effects of GST in the oncoming year as a baseline scenario (shift the y axis up by 5 percent). Then we will truly have a valid stress test. This stress test I repeat is a JOKE. The only way the stress tests are valid is if the world economy doesn't slow down!

Furthermore, in adverse scenarios, the smaller banks would likely need to re-capitalization! stay away from the smaller banks, they will need cash calls in the oncoming year. That is almost a 90 percent chance of occurring under the adverse scenarios. And we are going to get the adverse scenario no matter what due to our GST.

0 comments:

Post a Comment